AGEFI

– le 18 novembre 2021

In the best of both worlds, companies are profitable, generate profit but also take into account the considerations of its employees while improving its carbon footprint. Is an investment fund made up of such companies still efficient and competitive compared to a traditional fund? This is the question we will answer in this article.

Profitability and margin mainly characterize the objectives sought by investors when they put their money in an investment fund, but there are other criteria taken into account when it comes to ESG investing.

What does ESG investing stands for?

« E » stands for Environmental , « S » for Social and « G » for Governance. ESG financing refers to the consideration of non-financial factors such as the carbon footprint, the implementation of a human management, the quality of the management team, the leadership transparency,…

The challenge for the fund manager is to formalize his view of the company with all these non-financial criteria and to integrate sustainable development with financial criteria into his overall performance analysis in order to choose which company to invest in.

As the assessment of ESG criteria has only recently appeared compared to the analysis of financial criteria (such as turnover, EBITDA), the task of the manager is to properly formalize the approach of ESG criteria in order to be able to refine the evaluation of one company compared to another.

This is why the position of fund manager is very important because he is the one who meets the management teams, participates in the various conference calls and travels to the roadshows. He is constantly in contact with the different actors and for these reasons, it is important that he is the one who carries out the financial and extra financial analyses.

The positioning of an investment fund that is part of a Social Responsible Investment (SRI) approach will be transcribed through the objectives and the implementation of a coherent strategy.

Two approaches are recurrent when selecting the companies that will constitute the investment fund’s portfolio: exclusion or integration.

Sectoral exclusion is the simplest strategy to implement, it consists of excluding all controversial sectors such as tobacco, arms and coal. Nowadays, more and more funds are going further in the approach and integrating some additional factors. There are funds whose objective is to have a performance on the climate. This kind of funds will select companies that have a positive impact on this factor, because they are actors, through their services and products in the field of renewable energies or in energy efficiency or because in their operations, these actors are committed to the sustainable transition by decarbonizing their activities. This is the inclusion strategy. In the ESG inclusion strategy, a scoring will be made based on ESG criteria, and the fund will compose will top ESG scoring companies and companies that are improving the ESG scoring.

For some investors, companies that are involved in social responsibility are still seen as a hindrance, and question the over performance and risk compared to traditional companies. Numerous studies have demonstrated the over performance of ESG companies over the long term. A very interesting study, published in February 2021, by the Center for Sustainable Finance at NYU Stern[1], which conducted a meta-analysis (a global study based on 1000 studies released between 2015 and 2020) which brings several findings:

ESG companies are more performant in the long term and will outperform in times of crisis; mature companies in ESG are less volatile (has a smaller variation of its trading price over time); the exclusion strategy is less effective than the inclusion strategy.

After the financial crisis of 2007, sustainable indices have generally performed better than traditional ones. As shown below (see Figure 3), between 2004 and 2020, the number of ESG Focus Funds has grown by 144%[2].

In the past, such investments were considered a niche market and investors were mainly institutional. Is this still the case today?

The analysis made by Bloomberg intelligence Head of ESG revealed that « Global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management[3] ». This statement shows the trend for the investments funds in the coming years.

And what refers to institutional investors (companies or organizations that invests money on behalf of clients or members such as banks, insurance companies, pension funds, mutual funds,…), the shift towards a clientele that includes more and more individual investors in ESG funds is part of an effort to fight global warming. Those investors no longer see their investments solely from a financial point of view, but they become aware of the possibility of improving the world through the allocation of their savings.

All the arguments detailed above demonstrate that ESG funds, which are part of a long-term strategy, are a high-performance investment that makes sense for investors who can participate in the energy transition through finance.

But how does the individual make their choice? Nowadays, everyone claims to be “green”, in favor of ecology and do not hesitate to use greenwashing to blend in. How do you choose your investment fund?

The common practice is to analyze the top 10 companies that constitute the fund in order to identify whether these companies are indeed making efforts in favor of the energy transition.

Secondly, the regulator is carrying out in-depth work on the communication put in place by companies describing themselves as “green”. Numerous verifications are put in place by the regulator, and this from the constitution of the companies in order to give a certain confidence on the companies present on the market. Individuals can therefore rely more easily on companies stamped « green ».

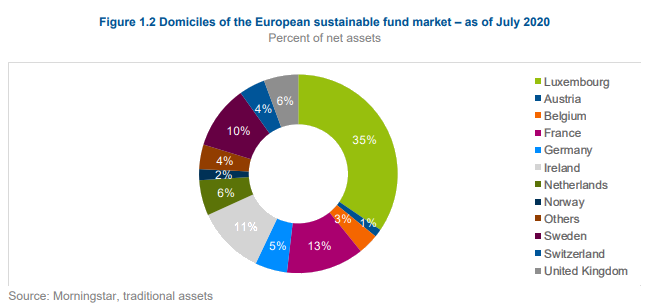

Luxembourg and Ireland are leading investment fund domiciles in Europe. A large amount of funds in Europe are domiciled in Luxembourg and Ireland (see Figure 4), but these are funds managed by subsidiaries of asset manager firms that are located abroad. The biggest part of the sustainable funds domiciled in Ireland were issued by US asset managers, to a lesser extent by British, Swiss and German firms. Sustainable funds domiciled in Luxembourg originate from the following countries: 30% from Switzerland, 25% from France, 12% from Germany, 8% from the USA and the rest from the UK, the Netherlands and other countries. Given the relevant role of Luxembourg and Ireland as funds hubs overall, considering the origin of the funds domiciled in Luxembourg and Ireland allows for a clearer picture of the size of the sustainable market in every European country.

Socially responsible investments will help improve both risk management and preservation of biodiversity, pollution prevention and circular economy.

Thanks to the adoption of the 2030 Agenda for Sustainable Development Goals (SDGs) and the signing of the Paris climate protection agreement, the market for sustainable funds has grown to become more diversified in terms of market players.

Moreover, in 2020 the sustainable fund market has shown great resilience through the Covid-19 pandemic it is a new growth opportunity and no longer a niche investment strategy.

Sustainable funds provided returns in line with comparable traditional funds while reducing downside risk. While, during a period of extreme volatility there is strong evidence that sustainable funds are more stable. Incorporating environmental, social, and governance (ESG) criteria into investment portfolios may help to limit market risk.

It is undoubtedly that this might to be a further incentive for all investors due to the fact that SRI indices overperform the conventional indices. There is therefore, a huge probability for these funds to become the new safe haven.

[1] https://www.stern.nyu.edu/experience-stern/faculty-research/new-meta-analysis-nyu-stern-center-sustainable-business-and-rockefeller-asset-management-finds-esg

[2] Source: Morningstar, 2019

[3] https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/

Par Max Brandao, consultant, et Mara Saccomanni, consultante chez Square.

AUTRES ACTUALITÉS EN RISK & FINANCE

Banque à réseau versus banque à zéro : qui écrira l’histoire ?

Paru dans Les Echos

EUDIW : enjeux et conséquences du portefeuille d’identité numérique de l’UE sur le secteur bancaire

Paru dans Le Journal Du Net

L’inclusion financière, un levier pour les banques

Paru dans Revue Banque